Our Metaplex Thesis

Publish Date: Oct 13, 2023

Author: James Ho

Executive Summary

Metaplex is an established NFT infrastructure protocol in the Solana ecosystem. They facilitate over 99.9% of the NFT mints. They have built the infrastructure standards for NFTs (Token Metadata) along with applications like Candy Machine and Creator Studio that make it easier for creators to set up fair launches.

While the NFT market broadly has seen huge declines (85-99% down for floor prices and marketplace volumes), Metaplex has seen mints grow 5X+ year over year, from the launch of Bubblegum, their program for minting compressed NFTs. [1]

Compressed NFTs by Metaplex has driven the cost of minting NFTs down by a factor of 1,000x+ (from $10+ on Ethereum to <$0.001 per mint on Solana). This has translated to a surge in experimentation for integrating NFTs into social, payments, creator, and physical infrastructure applications. Metaplex is minting 180M annualized NFTs, which compares to 25M for Ethereum (7X+ more). [2]

Metaplex has recently turned on fee switch to support immutability. If the fee switch had been turned on in 2022, Metaplex would have generated $13.9 million of revenue. [3]

Solana is well positioned to be successful with mainstream web3 consumer use cases, with its distinct architecture of parallelized computation and local fee markets. We believe NFTs can play a crucial role in this, as a primitive that represents any distinct digital content.

Unlike NFT marketplaces which has been disrupted again and again by competition, we believe that Metaplex faces very little competition and likely continues to be a leader in facilitating NFT mints through its infrastructure standards and front-end applications.

Metaplex has the potential to become a Shopify-like product allowing creators to mint, manage and monetize their NFTs. Over the next 3-5 years, we see Metaplex having the potential to power billions of annual NFT mints and generating $25-100M+ in revenue. [4]

Background

Non-fungible tokens (NFTs) represent a key new innovation in crypto over the last crypto cycle. NFTs are distinct digital identifiers that are recorded on a blockchain, used to demonstrate provenance, authenticity, and ownership over digital assets.

The first foray into NFTs involved the ERC-721 standard on Ethereum that was first introduced September 2017. CryptoKitties created one of the first blockchain games, allowing users to collect and breed digital cats (all represented as NFTs). This famously led to congestion of the Ethereum network in Nov/Dec 2017 and >20% of all network activity.

NFT’s big foray into the mainstream audience centered around digital profile pictures. CryptoPunks (launched June 2017) and Bored Ape Yacht Club (BAYC, launched April 2021) are among the highest valued collections, with 1 NFT worth $400K+ floor price at the peak of the 2021-22 market. Through that period, we saw NFT trading volumes on marketplaces grow from nothing in 2020 to $60B annualized. NFT marketplaces like OpenSea were valued at $13B+ at the peak of the market cycle, facilitating $2-3B+ in monthly volumes and earning $1B+ of annualized revenues with a 2.5% take rate.

Source: The Block ResearchAs with much else in crypto, NFT floor prices and trading volumes declined meaningfully over the last 2 years. Blue chip collections such as Punks and BAYC are trading down 80-90% vs their peak market values, while NFT marketplace trading volumes have declined >95% from $60B annualized to $3B annualized. Yet the fact that NFTs still annualize $3B+ in trading volumes and Punks, BAYC have $35-70K floor prices, demonstrates the power behind digital communities and culture. For perspective, eBay processed $74B in GMV in 2022.

NFTs over the 2021-22 period have been primarily associated with speculative JPEGs, not unlike Ethereum’s primary association with Initial Coin Offerings (ICOs) in the 2017-18 era. Yet since then, Ethereum and smart contracts have morphed into so much more. Today smart contracts are the driving force behind permissionless finance, stablecoins, decentralized autonomous organizations, governance, traditional asset tokenization, physical infrastructure networks, and more. Similarly, we see NFTs as a novel primitive over the coming decade that enables digital property rights and ownership of any content type.

A key barrier historically for ubiquity of NFTs to grow beyond highly speculative use cases, has been around the cost of mint. For the standard 10K NFT collection, it costs 176 ETH or nearly $300k USD today (~$800K at the peak) on the Ethereum network, which comes to $30 per NFT mint ($80 per mint). This may be an acceptable cost to users who are primarily speculating on the collection floor price, but prohibitive for daily use.

For NFTs to be ubiquitous, they need to structurally shift from being about scarcity to abundance.

Introduction to Metaplex

Metaplex is the protocol behind the NFT standard in the Solana ecosystem. The company was originally incubated within Solana Labs by a team including Stephen Hess (former Head of Product at Solana Labs), and began operating as an independent organization starting fall of 2021. Metaplex has built products allowing artists, brands, creators to create (“mint”) NFTs and launch self-hosted mint pages, through a combination of APIs and low-code tools.

Metaplex powers the vast majority of activity (99.9% of NFTs minted) with multiple product lines across both infrastructure and application tools. Some examples:

Token Metadata – Solana program responsible for attaching additional metadata to fungible or non-fungible tokens. For NFTs this includes the name, symbol, URI, traits, royalty fees, etc.

Candy Machine – leading minting and distribution program for fair NFT collection launches on Solana. It allows creators to bring their digital assets on-chain in a secure and customizable way.

Auction House – protocol that allows marketplaces to implement an escrow-less sales contract.

Fusion – program that adds on-chain tracking and composability around NFT ownership. It is used for complex ownership models to be implemented by creators.

Creator Studio – no-code, web based tool for creators, making it easy to create, sell and NFTs on Solana without writing a single line of code.

Bubblegum – program for creating and interacting with compressed Metaplex NFTs, which are secured on-chain using Merkle trees.

Source: Metaplex DocsSince inception, Metaplex has facilitated mints of 144K+ collections, 61.7M+ NFTs, 14M+ collectors and $1.1B+ in creator revenue. Minting NFTs on Solana costs 100x less than Ethereum, at just $2500-3000 for a 10k collection (translates to $0.25-0.30 per mint) compared to $250-300k on Ethereum ($25-30 per mint).

Source: Metaplex website as of 10/13/23Metaplex’s most commonly used programs include Candy Machine and Token Metadata. Unlike most other blockchains, Solana separates logic and data into two distinct components – these are called Programs and Accounts. Instead of storing data inside variables internally, Programs (holding application logic) interact with Accounts (holding state and data), with the ability to modify them. Candy Machine is one such program, as the leading mint and distribution program for fair NFT launches on Solana. Token Metadata is another such program that attaches metadata to both fungible and non-fungible tokens on Solana.

Source: Metaplex website as of 10/13/23Metaplex’s programs are available under open source license for everyone to publicly view and fork. While the source code is public, Metaplex’s license does not allow others to copy or fork the code for profit purposes, or to offer a competitive product or commercial substitute that reduces economic benefit to Metaplex. Furthermore, Solana’s architecture separating Programs and Accounts means that were a new startup to fork Metaplex’s NFT standard, many key players in the ecosystem (such as NFT marketplaces, wallets, custodians, and node providers) would all need to integrate that program. This comes with significant overhead of coordination.

In fact, Magic Eden (Solana NFT marketplace) had previously attempted this with their Open Creator Protocol (OCP), which defined a new standard for royalty-enforced NFT collections. This effort saw limited success and was later shut down.

The result of the above is that Metaplex has a strong and dominant role in the Solana NFT ecosystem, in building programs at both the application and infrastructure standard layer.

Compressed NFTs

Despite challenging market conditions for NFTs and crypto broadly, Metaplex has grown the NFTs minted with its infrastructure significantly from 500K per week (over much of 2022) to 3M+ per week today. This 5X+ growth has been driven by the launch of the compressed NFT standard which further drives the cost of minting much lower. Today it only costs $100 to mint 100K compressed NFTs, amounting to <$0.001 per mint.

Source: Dune AnalyticsMetaplex’s compressed NFTs program (known as Bubblegum) has achieved this breakthrough as a result of Solana’s Merkle tree program (known as account-compression). This is achieved by moving the storage of NFT metadata (image url, traits) off-chain through indexers and RPC node providers. Instead of storing a NFT's metadata in a typical Solana account, compressed NFTs store the metadata within the ledger.

The result is that compressed NFTs inherit the security and speed of the Solana blockchain, while reducing storage costs by moving this off-chain. Since the entire computational history is on the Solana ledger, if any indexer or RPC provider goes down, the entire state data can be reconstructed by replaying all historical transactions. Notably, all compressed NFTs are compatible with the regular NFT standard, and can be losslessly decompressed into regular Metaplex NFTs. In a way, this is similar to how rollups on Ethereum offload computation and state storage to a Layer 2 blockchain (Optimism, Arbitrum), while Ethereum itself stores the merkle root and data availability. This results in Ethereum being able to trustlessly reconstruct state should the L2 rollup blockchain be compromised.

Source: Solana Labs Metaplex introduced compressed NFTs in November 2022. Since then, 57M+ compressed NFTs have been minted. Due to the low cost of minting, numerous applications have found creative use cases:

DripHaus – platform connecting creators to fans by airdropping their work (art, music, games, comics) to fans. 20M+ compressed NFTs have been minted for just $2000 on Solana, which would have cost $300M+ on Ethereum.

Helium – decentralized network of 2M+ IoT hotspots that are user owned. Helium migrated from their own blockchain to Solana. In the process, they issued 1M+ compressed NFTs on Solana to represent the hotspots that users own.

Dialect – wallet to wallet messaging application. Emojis and stickers are tokenized into compressed NFTs, so they are collectible and ownable. Users can mint custom emojis and stickers and share them with their friends. More than 20K+ users have minted and collected these stickers.

Tiplink – crypto payments application that lets users send and receive money through a web link or URL. Tiplink allows new users to claim AI-generated compressed NFTs to have users test its product as a growth strategy. Tiplink has acquired more than 1M users (unique minters) through this acquisition strategy.

Source: Twitter, Solana Labs, Tiplink / Dialect websites (as of 10/13/23)Experiences like how Dialect, Tiplink, DripHaus adopt compressed NFTs would not be possible on Ethereum or any other ecosystem. As the price of minting NFTs has fallen to <$0.001, applications are finding creative ways to incorporate NFTs into everyday use cases – including payments, artwork, chat stickers, and physical infrastructure networks.

Furthermore, Magic Eden and Tensor have rolled out support for compressed NFTs on their marketplaces, demonstrating adoption of the compressed NFT standard from the Solana ecosystem.

Monetization

For much of its history, Metaplex has operated all its products free of charge. The company has been fortunate to raise $47M of venture funding from Multicoin Capital, Jump Crypto, Asymmetric, and many other leading funds, having sold 10.2% of tokens in the strategic round. This capital has funded the development and maintenance of a broad suite of programs across the Metaplex Program Library.

Towards late May 2023, Metaplex announced plans to further sustainability of the protocol. These changes include:

Roadmap to convert Token Metadata program into full immutability, which means it can no longer be upgraded or modified.

Access to the Token Metadata program will remain permissionless, all users will be treated equally, and no token gating with $MPLX either before or after.

Small fee introduction for usage of Token Metadata program, primarily 0.01 SOL (roughly $0.20 USD) for each creation of uncompressed NFTs.

Source: Metaplex Documentation, fees as of May 24, 2023Fee proceeds are used to fund development of other programs Metaplex maintains (such as Candy Machine, Auction House, Bubblegum for Compressed NFTs). Notably, these changes were vocally supported by key participants such as Solana Labs (from which Metaplex spun out), Magic Eden and Tensor (which are the largest Solana NFT marketplaces).

Source: TwitterIn 2022 Metaplex facilitated 22M NFT mints. This would translate into $4.4M in revenue had Metaplex monetized at 0.01 SOL ($0.20) per mint at today’s price, and $13.9M in revenue had they monetized at each day’s SOL price. From inception, Metaplex would have earned $23.5M in revenue monetizing at each day’s SOL price.Since the introduction of compressed NFTs, over 99% of ongoing NFT mints are now done under Bubblegum. Note that compressed NFT mints are not monetized today. Only standard NFTs that use the Token Metadata program are currently monetized. We believe in the medium term, Metaplex’s primary focus should be on furthering experimentation, usage and adoption of Bubblegum, which can have significant growth potential among mainstream consumer crypto applications.

Historically, NFTs have been about scarcity. This is a logical conclusion in a world where the cost of NFT mints is $20-30, by definition only supporting highly valued, artificially scarce assets like CryptoPunks and BAYC. However, as prices are reduced by a factor of 1,000x+ we believe NFTs shift to becoming a core infrastructure primitive that powers digital experiences – whether across consumer payments, gaming, social, identity, music, physical infrastructure, and many others.

Going forward, we believe NFTs are increasingly about abundance.

Metaplex has built the leading NFT infrastructure standards and applications, that is the most usable and scalable for consumer products that reach 100M+ users. Metaplex has proven $4-14M of annual revenue potential in 2022, from a limited set of use cases. We believe the protocol has the potential to power billions in annual NFT mints (from 150-200M annualized today), continue to build leading infrastructure standards and applications, and build into a sizable revenue and business outcome.

Valuation & Scenario Analysis

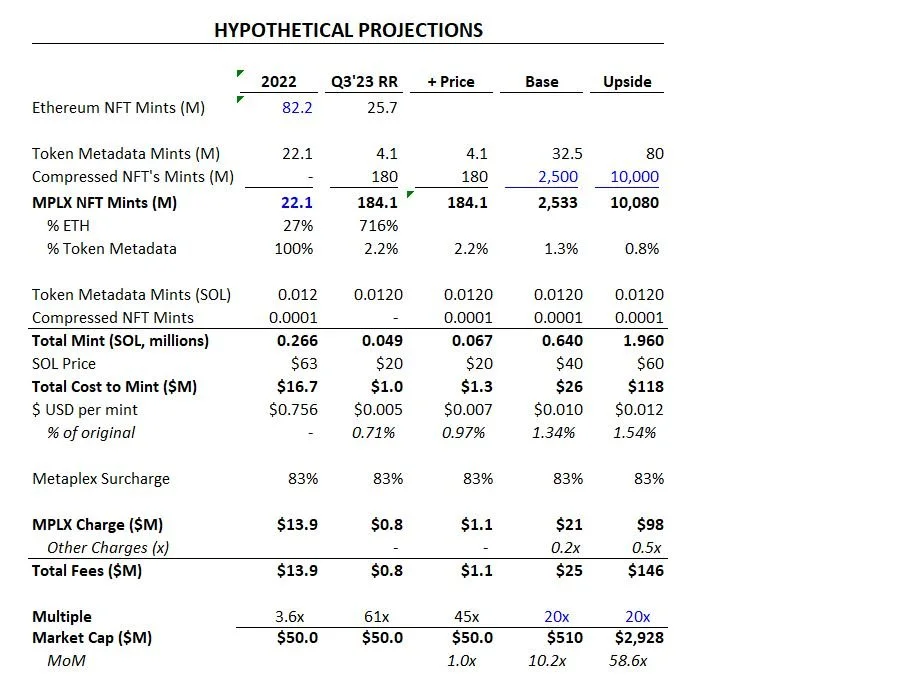

Given the amount of experimentation on Metaplex with compressed NFTs and monetization is just turning on, it is difficult to predict what the future state of Metaplex will look like. We have attempted to contextualize what various scenarios could look like:

Our 2022 Scenario highlights what Metaplex revenue would have been if Metaplex had turned on fees. Given minting costs on Solana were significantly cheaper than Ethereum and high NFTs valuations, we believe that Metaplex would have had the pricing power to implement fees, without losing many mints, and earn $14M revenue that year.

Our Current Scenario highlights the impressive growth of compressed NFTs, annualizing Q3 2023 run-rate numbers. Impressively, Metaplex mints of 180M+ annualized are 9x that of the mints on Ethereum today and has 2.7x the number of mints on Ethereum in 2022. As minting costs have declined by a factor of 100x (in SOL terms), we have seen a corresponding 30x increase in mints. This is despite NFT trading volumes and floor prices being down 95%+.

Our +Pricing Scenario assumes Metaplex will charge a similar 83% mark up to their compressed NFT product as they do for their traditional mints. Given this only increases the price of a compressed NFT from $0.002 to $0.004 in USD terms, we believe this will not drastically affect volumes of NFTs being minted. Metaplex would be able to generate $1M of revenue at these current valuations. For context, OpenSea which did $7.6B of revenue in 2022 is doing $30M of revenue. [5]

Our Base Scenario assumes Metaplex is able to 10x usage from here. Solana price increases from $20 to $40. The result of this is $20M+ of mint revenue at an average cost of $.02 per NFT across 2.5B NFT mints. Metaplex is also able to add on value added services around the management and sale of NFTs. Similar to Shopify which allows an online merchant to create and manage a store, Metaplex is attempting to build a full stack service for the issuance and management of NFTs. We believe this could add another $5M of application related revenue (at $10-20/month, this would require 20-40K subscribers). At a 20x multiple, this would support a $500M valuation.

Our Upside Scenario assumes Metaplex is able to power 10B of annual NFT mints. For context, this compares with the following annual figures:

2.5 billion blog posts

8.6 billion TikTok videos uploaded

$70 billion spent on virtual goods (assuming $10 per item = 7 billion items)

200 billion tweets

1.8 trillion photos

8.4 trillion text messages [6]

Solana price increases to $60 (average from 2022 period). Although the cost per mint increases as SOL price increases, we believe if Solana ecosystem becomes more and more valuable, minters would be willing to pay a commensurate premium with minting on Solana. At a 20x multiple, this would translate into a $3B outcome.

Disclaimer: all forecasts and assumptions are hypotheticalRisks & Mitigants

NFT use cases are still early and emergent. Most of the NFTs minted in 2021-22 period related to speculative JPEGs. Today, we are seeing experimentation across messaging (stickers), payments (growth acquisition), creator content (discovery) and physical infrastructure (tokenized representation) – but these are all early and may not be durable or eventually monetizable if applications do not build businesses on top.

Risks from Solana interfaces. Because of how Solana separates logic and state into Programs and Accounts, it has allowed specific programs such as Metaplex Token Metadata or Solana Program Library (SPL) to dominate the standards for SPL-token and NFT mints. Solana ecosystem has been working on developing interfaces, which would mirror functionality in the EVM ecosystem where developers can fork the ERC-20, 721, or 1155 standards for issuance of fungible and non-fungible tokens. This effort is still a work in progress, and developers would need to build a new codebase to mirror/surpass functionality Metaplex provides today for already low fees. Nonetheless, this could be a long-term risk.

Solana ecosystem dependency. Today the vast majority of activity sits within Ethereum or EVM compatible ecosystems, whether this involves defi, stablecoins, payments, NFTs, and others. Solana has proven itself to have a strong community despite the FTX fallout, with a distinct architecture around parallelized transaction processing, local fee markets, and scalability that grows in step function with compute and Moore’s law. However, it is possible ultimately NFTs, even if successful as a widely adopted primitive in daily consumer applications, exists outside of Solana as the Ethereum ecosystem continues to mature and solve its own scalability challenges.

Special thanks to Dorian Lee (CEO, Metaplex Studios), Mackenzie Hom (Director of BD, Metaplex Studios), Shayon Sengupta (Multicoin Capital) for their review and input.

[1] Total Metaplex NFT mints of 45 million in Q3 2023, compared to 7.9 million in Q3 2022 (Dune)

[2] ERC-721/1155 mints on Ethereum were 6.2 million in Q3’23, which translates to roughly 25M annualized (Dune)

[3] Metaplex was responsible for 22 million NFT mints in 2022. Their current fees are 0.01 SOL per mint. Revenue calculation uses the SOL price for each day’s mint in 2022 (Dune, Artemis Sheets)

[4] All forecasts and assumptions are hypothetical. See “Valuation & Scenario Analysis” section for details

[5] OpenSea revenue estimate calculated based on volumes multiplied by 2.5% take rate

[6] Sources for annual number of blog posts, Tiktok, virtual goods, tweets, photos, and text messages

LEGAL DISCLAIMERS

THIS POST IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON AS INVESTMENT ADVICE. This post has been prepared by Modular Capital Investments, LLC (“Modular Capital”) and is not intended to be (and may not be relied on in any manner as) legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy any securities of any investment product or any investment advisory service. The information contained in this post is superseded by, and is qualified in its entirety by, such offering materials.

THIS POST IS NOT A RECOMMENDATION FOR ANY SECURITY OR INVESTMENT. References to any portfolio investment are intended to illustrate the application of Modular Capital’s investment process only and should not be used as the basis for making any decision about purchasing, holding or selling any securities. Nothing herein should be interpreted or used in any manner as investment advice. The information provided about these portfolio investments is intended to be illustrative and it is not intended to be used as an indication of the current or future performance of Modular Capital’s portfolio investments.

AN INVESTMENT IN A FUND ENTAILS A HIGH DEGREE OF RISK, INCLUDING THE RIKS OF LOSS. There is no assurance that a Fund’s investment objective will be achieved or that investors will receive a return on their capital. Investors must read and understand all the risks described in a Fund’s final confidential private placement memorandum and/or the related subscription posts before making a commitment. The recipient also must consult its own legal, accounting and tax advisors as to the legal, business, tax and related matters concerning the information contained in this post to make an independent determination and consequences of a potential investment in a Fund, including US federal, state, local and non-US tax consequences.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS OR A GUARANTEE OF FUTURE RETURNS. The performance of any portfolio investments discussed in this post is not necessarily indicative of future performance, and you should not assume that investments in the future will be profitable or will equal the performance of past portfolio investments. Investors should consider the content of this post in conjunction with investment fund quarterly reports, financial statements and other disclosures regarding the valuations and performance of the specific investments discussed herein. Unless otherwise noted, performance is unaudited.

DO NOT RELY ON ANY OPINIONS, PREDICTIONS, PROJECTIONS OR FORWARD-LOOKING STATEMENTS CONTAINED HEREIN. Certain information contained in this post constitutes “forward-looking statements” that are inherently unreliable and actual events or results may differ materially from those reflected or contemplated herein. Modular Capital does not make any assurance as to the accuracy of those predictions or forward-looking statements. Modular Capital expressly disclaims any obligation or undertaking to update or revise any such forward-looking statements. The views and opinions expressed herein are those of Modular Capital as of the date hereof and are subject to change based on prevailing market and economic conditions and will not be updated or supplemented. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

EXTERNAL SOURCES. Certain information contained herein has been obtained from third-party sources. Although Modular Capital believes the information from such sources to be reliable, Modular Capital makes no representation as to its accuracy or completeness. This post may contain links to third-party websites (“External Sites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites. These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Sites.