Our Stride Thesis

Publish Date: Dec 4, 2023

Author: James Ho

Executive Summary

Stride is a liquid staking protocol on the Cosmos ecosystem with significant market share (90%+) and >$60M TVL (total valued locked). They support major Cosmos chains including ATOM (Cosmos Hub), OSMO (Osmosis), INJ (Injective), JUNO (Juno) and many others.

Liquid staking is early in its penetration curve in the Cosmos ecosystem. In Ethereum, 41% of all ETH staked is done through a liquid staking provider (Lido, Rocketpool, Frax, Coinbase etc). In contrast, only 2% of ATOM and 7% of OSMO is liquid staked, presenting significant opportunity for additional category penetration.

Liquid Staking Tokens (LSTs) have significant appeal to customers by unlocking capital efficiency on staked assets. By issuing users a receipt token (stOSMO, stATOM), Stride allows users to earn staking yields while freely using the assets in DeFi. Furthermore, most Cosmos chains have a 14-30 day unbonding period for staked assets, a significant amount of time for users to wait to unstake. LSTs allow users to sell immediately if desired, for some reasonable amount of market slippage.

Liquid staking as a category has strong network effects and tends towards winner-take-most share dynamics. Lido holds nearly 80% share of LSTs on Ethereum given the deep liquidity they enable for their stETH pair, resulting in even more users preferring to use Lido over competitors. We expect similar network effects to take hold in for Stride in the Cosmos ecosystem, given its dominant share of 90% and growing.

Stride intends to support liquid staking pairs for new Cosmos chains like Celestia (TIA) and dYdX. Combined these represent $10B+ in FDV, a significant expansion of the addressable market for Stride in the Cosmos ecosystem vs $6B of addressable market cap today.

We see a path for Stride to generate $20-70M in fee income, as Cosmos Ecosystem grows to $20-50B of addressable market cap assets (from $5-6B today), 15-30% liquid staking penetration, and with Stride continuing to hold 90% market share. Applying 50x multiple results in $1-3B+ FDV outcome for Stride. [1]

Proof of Stake

Proof-of-stake (PoS) is a consensus mechanism for determining how transactions are processed and new blocks are created. Ethereum historically had its chain secured by a proof-of-work (PoW), in which miners spend hash power (in the form of GPUs and electricity) to guess a random encrypted hexadecimal number. This is also Bitcoin’s current security model.

After many years of planning, in September 2022, Ethereum completed the merge, which transitioned Ethereum from PoW to PoS. There are many reasons why most smart contract chains have moved from a PoW to PoS security and sybil resistance model, which include:

Energy Consumption: PoW is secured by spending real-world resources (in the form of compute and electricity). PoS is secured by the value of the native network asset (ETH, SOL, AVAX, ATOM). This results in 99.9% less energy consumption for PoS compared to PoW networks.

Network Alignment: PoW is secured by economic incentives. The network creates new issuance which is given to miners, in return for spending real-world resources which cost money. However, the miners typically are selling the new issuance immediately (e.g. BTC) to recoup expenses of running the mining facility. In PoS, the network is secured by the owners (who hold and have bought the native network token). The theory is that this creates alignment between the owners of the network, who are incentivized to secure the network properly.

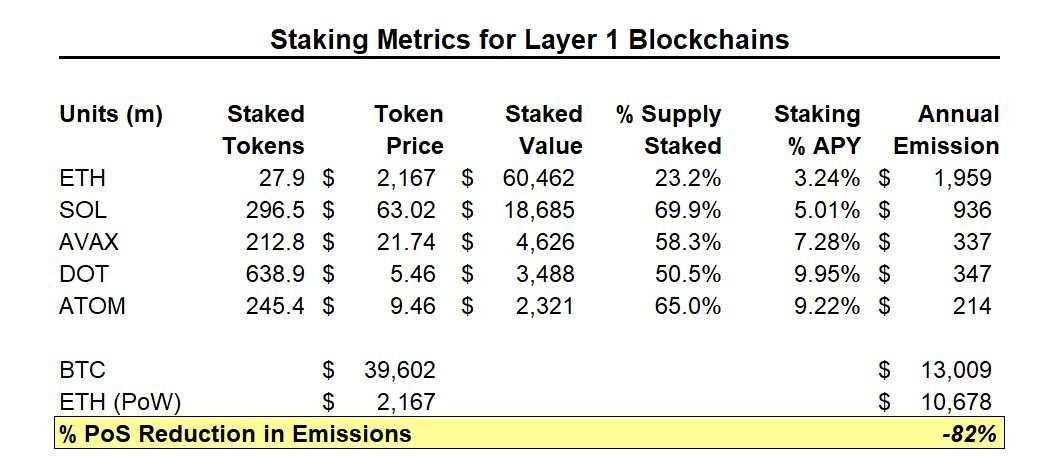

Reduction in Emissions: Under PoW networks, the network must spend $1 of emissions to gain $1 of security (in the form of real world spend). This requires the network to have significant amount of new issuance on an ongoing basis. With PoS, the stakers do not have significant real-world spend, and instead simply need issuance (often in the 3-10% range) that compensates them for illiquidity of staking the asset. This means the network spends $0.03-0.10 for $1 of economic security, a model that is more economically sustainable long-term. Ethereum after transitioning to Proof of Stake, spends >80% less in annual issuance to secure its network.

With the above benefits, nearly all major smart contract chains by TVL utilize PoS today to secure their network. This includes Ethereum, Solana, Avalanche, Polkadot and Cosmos Hub.

Source: Coinbase Earn Website as of December 3, 2023. Prices pulled from Artemis Sheets plugin around 20:43 UTC on December 3, 2023

Introduction to Liquid Staking

Liquid staking has emerged as a very large category in defi, with the largest success story being Lido. Lido is now the #1 protocol in all of crypto with $20B+ in TVL (total value locked) which represents nearly 1/3 of all Ethereum staked. Lido as a protocol earns $80M+ of annualized fees.

Source: Defi Llama Home Page (screenshot from December 3, 2023 around 20:43 UTC)

At a high level, Lido takes in ETH into its smart contracts, which it then assigns to a set of node operators to stake on the protocol’s behalf. These node operators include the likes of Figment, stakefish, Everstake, and Blockdaemon.

After depositing ETH into the Lido protocol, the user receives back an ERC-20 receipt token called stETH. This represents the user’s staked ETH in Lido protocol, both the value of the initial deposit and the ongoing staking rewards. There are a few use cases for this stETH token:

Borrow/Lend: stETH can be deposited in lending protocols such as Aave, if the user wants to use it as collateral to borrow assets (e.g. USDC stablecoin).

AMM Liquidity: stETH can be deposited into trading protocols such as Uniswap, Curve, if the user wants to provide liquidity and earn fees. The Curve pool for wstETH/ETH earns 2% in annualized fees, which is additional to the 3-4% ETH staking yield on Lido.

Yield Hedging: stETH can be deposited into Pendle (yield defi primitive) which allows the user to lock in their staking yield over a duration of time.

Sell in Open Market: typically to unstake ETH through Lido, the user would need to wait a period of several days to weeks depending on the Ethereum to exit queue. If the user does not want to wait, they can sell stETH on the open market. Selling 1000 stETH in the open market ($2M+ USD) incurs roughly 10-15bp of slippage.

Source: Defi Llama Swap screenshot as of December 3, 2023 around 20:43 UTC

Like much else in defi, the stETH token can be integrated and adopted by any defi protocol that wishes to support it (just like Aave, Uniswap, Curve, Pendle all have). Each additional protocol which supports stETH creates additional utility and demand for users of liquid staking.

Lido’s success by securing $20B+ in assets, generating $80M+ in annualized fees (of which $40M+ is kept for the Lido DAO) has resulted in a $2B+ FDV outcome (top 35 token by market cap). Notably the liquid staking market tends to have “winner take most” dynamics. Lido holds nearly 80% share of the LST market on Ethereum, with the 2nd largest player Rocketpool having nearly 10x less ETH staked than Lido does ($2B Rocketpool vs $18B Lido).

Source: Defi Llama Liquid Staking Dashboard (screenshot as of December 3, 2023 around 20:43 UTC)

These network effects are driven by a few factors:

Liquidity depth that Lido stETH has vs other LSTs: on Curve (the primary DEX for stable assets), the stETH/ETH pool has $220M of TVL for liquidity earning 2% APY. In contrast the rETH/ETH pool has $8M in TVL. The increased depth of liquidity for stETH means that holders of stETH can exit their position for less slippage and market impact, compared to holders of rETH, which is one of the key value props of any given LST.

Security and Lindy Effect: staking involves earning a relatively low APY (3-4%) on a significant portion of user assets. This means security is of the highest importance, in terms of the protocol not getting hacked (e.g. stETH being incorrectly issued and redeemed for ETH). As a result, users value the liquid staking protocol with the longest history of being secure for its track record of security and lindy associated.

DeFi Integrations: the largest LSTs tend to have more integrations with rest of the defi ecosystem (across borrow/lend, AMMs, yield protocols, derivatives collateral, etc) which results in added utility for the stETH pair vs other smaller LSTs. 36% of the stETH is utilized within DeFi across liquidity pools and lending.

These network effects have cemented Lido’s dominance, which holds nearly 1/3 of total ETH staked and has steadily grown share over the past 2-3 years. Lido continues to benefit from the steady rise in the % of ETH staked as well. In fact, Lido is so dominant many have called for checks on its systematic importance to Ethereum, which now includes Lido + stETH dual token governance, as a check on the Lido DAO being aligned with Ethereum/stETH holders.

Source: Messari Report “Overdone Stake” by Kunal Goel

Lido’s success (>$2B FDV protocol) along with its strong network effects in the LST category, have led to similar attempts in other L1 ecosystems including Solana (Marinade, Jito), Avalanche (BENQI), Binance Smart Chain (Binance, Stader) and Cosmos chains (Stride).

Liquid staking penetration varies widely by ecosystem. Ethereum is by far the most mature with 41%, followed by most others in the 2-7% range.

Source: Defi Llama, Coinbase Earn, Staking Rewards Websites

Cosmos Overview

Unlike other major L1 ecosystems, the Cosmos Ecosystem is designed as an “Internet of Blockchains”. Cosmos provides an open source SDK (the “Cosmos SDK”) which developers can use to write and launch their own custom blockchain. The first of these chains was the Cosmos Hub ($ATOM, $2.7bn circulating market cap). ATOM is meant to serve as the economic center of this interchain and connect/secure other chains in the Cosmos ecosystem.

Over time, many other blockchains have launched in the Cosmos ecosystem using this open source SDK, including Osmosis (AMM), Injective (defi focused L1), Sei (defi focused L1), Celestia (data availability layer), dYdX (perpetuals trading), Kujira (Cosmos DeFi), Terra (now defunct UST stablecoin), and others. Each of these chains are their own PoS blockchain, secured by their own validator set and consensus. This means for each of these blockchains, there is a native token (OSMO, INJ, SEI, TIA, DYDX, KUJI, LUNA) which is used to secure the network – just like ETH, SOL, AVAX are used to secure their respective blockchains.

Most Cosmos chains are built with some version of BFT (Byzantine Fault Tolerant) where consensus is achieved when 2/3 of the nodes agree on state for blocks to finalize. The result is that most rely on a delegated Proof-of-Stake model, where there is a limit on the number of validators that can participate in consensus to still allow fast block finality times (within a few seconds). To put in contrast, Ethereum has no limit on the validator count (roughly 880k validators as of December 3, 2023, each with 32 ETH), similarly requires 2/3 of validators to attest to finalize blocks, and results in much longer period of 13 minutes for blocks to finalize.

One important aspect of the Cosmos ecosystem is the existence of IBC (Inter-Blockchain Communication) as a standard for trustless bridging between Cosmos chains. IBC is a protocol that handles the transport and authentication of data. By defining a standard that each Cosmos-built chain can implement, this allows bridging to be performed without additional security assumptions unlike other bridges that rely on multi-sig (Multichain), optimistic proofs (Synapse) or active validator sets (Axelar) when bridging across non-Cosmos chains. This ability to trustlessly bridge with IBC is why Cosmos is referred to an “Internet of Blockchains” that can all communicate and interoperate with each other.

Source: IBC Documentation

Just like other PoS blockchains, Cosmos chains have an unbonding period for tokens that are staked. On the low end this is 14 days (Osmosis) and on the high end is 30 days (dYdX). Most Cosmos chains have a 21 day unbonding period. While assets are staked and securing each Cosmos blockchain, these assets are unable to be used in defi (for borrow/lend, providing liquidity, hedging yield), along with the long wait times users must wait should they choose to sell their assets.

Source: Coinbase Earn, Staking Rewards Websites

Introduction to Stride

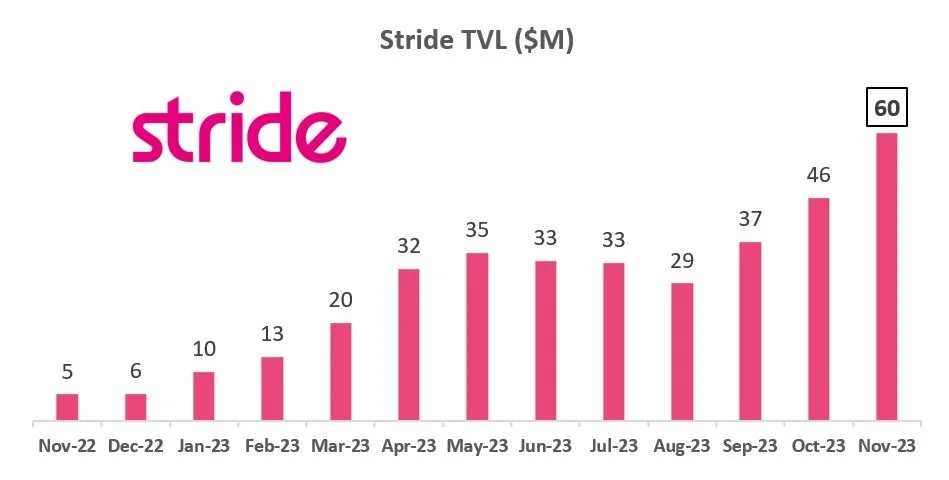

Stride has rapidly emerged as a large liquid staking protocol in the Cosmos Ecosystem. The protocol was founded June 2022 by Vishal Talasani, Aidan Salzmann and Riley Edmunds. They raised $6.7M of seed funding from funds including North Island VC, Distributed Global and Pantera Capital.

Stride’s protocol launched in September 2022 and has grown to $60M+ TVL over the past year, supporting all major Cosmos chains/tokens including ATOM, OSMO, INJ, JUNO, and with upcoming support for Celestia and dYdX.

Source: Stride Website (https://app.stride.zone/). Screenshot as of December 3, 2023 around 20:43 UTC.

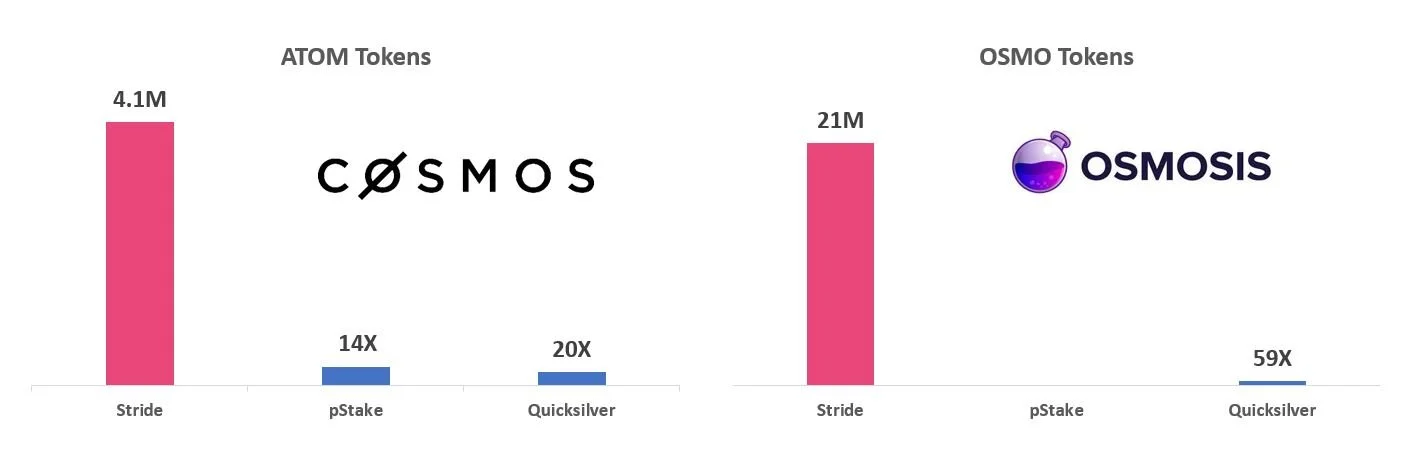

Cosmos has 3 major liquid staking players – Stride, pStake and Quicksilver.

pStake was the first to launch in February 2022 and quickly attracted $60M TVL with a token airdrop and support for the OSMO token (called stkOSMO). However, over the course of the bear market and the past 18 months, Stride has rapidly ascended and overtaken pStake in TVL (~$60M STRD vs $3M pStake today).

Quicksilver is another new player to emerge but has struggled to breakout of $2-3M in TVL.

Source: Defi Llama

Today Stride dominates the LST market in the Cosmos ecosystem with over 90% share of LST TVL.

pStake and Quicksilver each hold 4% share.

Note that Lido used to have ~100% of liquid staked assets in the Cosmos ecosystem with its LST for LUNA, with nearly $10bn of TVL from stLUNA at peak (April 6, 2022). On May 10, 2022, LUNA began to death-spiral towards 0 as its stablecoin UST de-pegged and LUNA was infinitely minted. Subsequently, Lido shut down Terra support, focused its efforts towards Ethereum, and today does not have any LSTs in the Cosmos ecosystem nor any known plans to.

Source: Defi Llama

Staking penetration in the Cosmos ecosystem is still nascent today, with 2% penetration of ATOM, and 7% penetration of OSMO. These two chains today represent >85% of Stride’s TVL. Compared to 41% penetration on Ethereum (and growing) this represents 5-20X additional opportunity for ATOM/OSMO, prior to the addition of other Cosmos chains supported, and new chain expansion (Celestia, dYdX).

Stride has 14-20X more ATOM tokens than two competitors (holding >85% share of liquid staked ATOM), and 59X more OSMO tokens than Quicksilver. (holding >95% share of liquid staked OSMO). The lead is substantial, and we believe will be maintained over time.

Stride also has >95% share for other LSTs including for INJ, EVMOS and JUNO.

Source: Defi Llama

In our view, Stride has won through numerous reasons:

Broad Chain Coverage – Stride supports 10 blockchains in the Cosmos ecosystem. pStake only supports 2 assets pairs (ATOM and XPRT) which has not changed since its February 2022 launch.

Ecosystem Alignment – Stride has closely linked and aligned itself with the Cosmos ecosystem. Beginning July 19, 2023, Stride began to leverage ATOM (Cosmos Hub) for economic security (which means staked ATOM holders secured the Stride blockchain and would handle block production). In return, Stride shares 15% of its emissions and protocol revenue with ATOM.

Stronger Economic Security – leveraging ATOM for consensus means that Stride has significantly stronger economic security guarantees than pStake which does not (<$10M circulating MC). Furthermore, Stride’s blockchain is explicitly minimal and they do not have any non-LST products on its roadmap. This simplifies the chain for security benefits.

Network Effects – as Stride has hit an inflection with the asset support in Cosmos, network effects set in. There are minimal code changes to additionally support new Cosmos chains with IBC enabled, which means that Stride’s scale and lindy makes it the most secure option for new Cosmos chains (Celestia, dYdX) to prefer and partner for their LSTs.

Deep AMM Liquidity – Stride has significantly deeper liquidity on AMM pools than its competitors. Stride has $17M+ of stATOM liquidity on Osmosis, compared to pStake having <$1M for stkATOM liquidity. Often this is done through “Protocol Owned Liquidity” (POL) for the host chains, which reduces the incentives Stride has to give out to scale a given LST pair. For example, Osmosis deployed $11M worth of OSMO to a stOSMO liquidity pool, and Juno deployed $1.65m worth of Juno to a stJUNO liquidity pool.

DeFi Integrations – Stride LSTs today can be used in a variety of Cosmos applications including Umee ($6.5M TVL), Shade ($3M), Kujira ($1.5M), Mars ($1M) and others. These increase the utility and network effects of Stride LST assets. Stride’s singular focus on LSTs and not competing with other defi protocols, also allows them to get more widely integrated.

Source: Osmosis Zone website, screenshot as of December 3, 2023 around 20:43 UTC

Stride charges a 10% take rate on the staking income collected through its protocol. Of this, 8.5% goes to the Stride protocol (to stakers of the STRD token), and 1.5% goes to ATOM / Cosmos Hub for providing economic security to the Stride blockchain.

There are a few key differences between staking economics on Cosmos vs Ethereum:

Validator Expenses: On Ethereum, every stake of 32 ETH requires a new validator node to be spun up. As a result, Lido charges 10% take rate (same as Stride) but has to give 5% to the validator, and the Lido DAO keeps the remaining 5%. Because Cosmos blockchains run on a delegated PoS or equivalent model, where stake is just delegated to the existing larger validators, there is no incremental cost or fee share Stride has with validators. The result is a higher margin, more profitable liquid staking protocol in terms of net fees.

Staking Yields: Cosmos chains tend to launch with much higher rates of emission and inflation. For example, ATOM has 18% APY, OSMO 9%, JUNO 15%, INJ 15%. This compares with Ethereum’s current staking of 3-4%. This naturally tends towards LSTs capturing a larger share of the economics, and makes LSTs a more compelling value-add especially when also deployed in defi protocols.

As TVL has grown from $5M to $60M over the past year, and with an average 16% staking APY, Stride has grown to nearly $1M of annualized revenue.

Source: Defi Llama

We believe over the next 6-12 months, there are numerous tailwinds and call options to Stride’s growth from the following Cosmos ecosystem chains. Stride has already stated intentions to support dYdX and Celestia liquid staking (via stDYDX and stTIA tokens) [2]

dYdX ($3-4B FDV): dYdX is the largest decentralized derivatives exchange, facilitating $400B+ in volumes and generating $100M in annualized fees annually. dYdX has been working on a product upgrade (v4), moving its trading platform from a StarkEx chain to their custom Cosmos blockchain. Importantly, trading fees will accrue now to DYDX token holders who stake (with a 30-day unbonding period). dYdX has the potential to be one of the largest blockchains by FDV in the Cosmos ecosystem as it grows market penetration of decentralized perps from 1-2% to 30% like in spot markets. On November 21, 2023, Stride announced the coming launch for stDYDX and 250,000 in STRD emissions to bootstrap early adoption.

Celestia ($8-9B FDV): Celestia is one of the leading data availability (DA) layers that is part of Ethereum’s modular scaling roadmap. They recently deployed to mainnet on October 31, 2023. Celestia will likely grow with usage of Ethereum and its L2s. Stride has posted to Celestia governance to kick off support for LSTs (called stTIA).

Akash ($400M+ FDV): Akash is a decentralized compute marketplace, which has recently focused on GPUs. Since GPU mainnet launch in September, Akash has scaled to ~200 GPUs and annualized GMV of ~$500K-1M. Importantly, a portion of the 20% take rate that Akash charges will be distributed to Akash stakers, in addition to the annual emissions.

Noble (native USDC on Cosmos): Circle recently launched native USDC support on Cosmos, via Noble which is an app-chain purpose built for native asset issuance. Today there is $30M+ of Noble USDC on Cosmos. As Cosmos sees an influx of demand vectors (from dYdX, Celestia, Akash), Noble USDC issuance on Cosmos can grow significantly which stimulates activity in other Cosmos appchains like Osmosis which accounts for a large part of Stride’s TVL.

To put in perspective, dYdX and Celestia add $10B+ of FDV to Stride’s addressable opportunity, compared to ~$6B from its existing supported chains. We believe these can be powerful additional tailwinds to Stride’s growth, in addition to continued LST penetration on existing chains (ATOM, OSMO, etc).

Generally speaking, Stride intends to be on the ground floor of any new Cosmos chain launch. As long as IBC/Cosmos SDK remain attractive for builders to deploy an app chain, Stride can continue to support, partner and benefit from the growth of new ecosystems.

Source: Artemis Sheets. Prices and FDV as of December 3, 2023 around 20:43 UTC.

Valuation & Scenario Analysis

Below, we present a few scenarios for Stride’s key drivers. In our base assumption:

We have assumed Stride’s addressable FDV grows from $6B to $25B.

Stride currently has $6B in addressable FDV from its existing chains which include ATOM, OSMO, and INJ primarily. We assume this grows to $10B over a market cycle.

Stride is working on support for DYDX and Celestia (TIA) which represent nearly $10B of FDV today. We assume +50% expansion to $15B as we are constructive on both DYDX and Celestia.

Staking rate across Cosmos chains is held constant at 50%.

No changes for the major existing chains such as OSMO, ATOM.

DYDX will return its fees to token holders with the new product which should drive staking rates to comparable ranges vs other L1/Cosmos blockchains. Currently there are already 16M+ DYDX tokens that are staked.

Celestia (TIA) requires a robust validator set to secure its data availability layer and will likely drive staking rates similarly high.

Liquid staking penetration grows from 2% to 15%

On Ethereum, liquid staking penetration is 41% of all ETH staked (with LDO having >30% of this share).

As the activity in the Cosmos ecosystem broadly increases (across DeFi, AMM, borrow/lend, perps trading) we believe LST penetration can grow meaningfully from 2% to 15%, which is still well below Ethereum levels.

Cosmos tends to have longer unbonding times than most other chains (21+ days) which should translate into a bigger tailwind to LST penetration.

Market share remains stable at 90%.

LSTs tend to exhibit winner take most effects as seen with Lido on the Ethereum ecosystem.

Stride has grown from 72% to 92% share since Jan 1, 2023 and we believe can continue to dominate this market.

Stride maintains 8.5% take rate as exists today.

We believe it’s possible for Stride to exhibit modest pricing power over time, but do not assume this in our base case or upside forecast.

Disclaimer: All forecasts, assumptions, and performance metrics are hypothetical

Risks & Mitigants

There are a few key risks we are actively monitoring for our investment in Stride:

Exposure to Cosmos Ecosystem: today >85% of Stride’s TVL is tied to just two Cosmos chains – ATOM (63%) and OSMO (24%). This makes it very tied to the success of these two projects, and the market cap / token performance. We believe this concentration risk will decline over time as Stride expands to supporting new chains with distinct demand vectors. For instance, usage of dYdX is tied to the perpetual trading market, and Celestia is tied to Ethereum rollup demand for data availability, bringing more diversity to Stride’s ecosystem exposures.

Since the start of 2023, Stride has grown its % TVL exposure to non-ATOM/OSMO blockchains from 2% to 14-15%.

Source: Defi Llama

Competitive Risks: while liquid staking at scale tends to be a winner-take-most market, the Cosmos LST market is still nascent today with only 2% category penetration. The Cosmos ecosystem has gone through a few waves of dominant players (Lido, pStake) that later lost share in the market as the tides changed (collapse of LUNA, crypto bear market). There is still a risk that Stride fails to dominate liquid staking in the Cosmos ecosystem. Recently there are new players such as Milky Way looking to compete for LST pairs for Celestia (TIA).

Osmosis Superfluid Staking: Osmosis introduced Superfluid Staking in early 2022, which allows liquidity providers on the Osmosis DEX, be able to collect OSMO staking rewards while providing AMM liquidity. While this is not exactly the same as a liquid staking protocol, it could act as a substitute for stOSMO by Stride (22% of TVL). Superfluid Staking only allows LPs to receive 75% of the OSMO staking yield compared to 90% for holding stOSMO (after Stride’s 10% fee), so we believe Stride offers a superior product. In addition, Stride has been able to succeed in the OSMO ecosystem (8% liquid staking penetration, even higher than ATOM) despite competition against the superfluid staking option over the past 12-18 months.

Special thanks to Vishal Talasani (Co-Founder, Stride), Jeff Kuan (Axelar), Paul Veradittakit (Pantera Capital), Cody Poh (Spartan Group) for their review and input.

[1] All forecasts and assumptions are hypothetical. See “Valuation & Scenario Analysis” section for details

[2] Forward looking statements based off public twitter, governance and blog posts by Stride

LEGAL DISCLAIMERS

THIS POST IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON AS INVESTMENT ADVICE. This post has been prepared by Modular Capital Investments, LLC (“Modular Capital”) and is not intended to be (and may not be relied on in any manner as) legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy any securities of any investment product or any investment advisory service. The information contained in this post is superseded by, and is qualified in its entirety by, such offering materials.

THIS POST IS NOT A RECOMMENDATION FOR ANY SECURITY OR INVESTMENT. References to any portfolio investment are intended to illustrate the application of Modular Capital’s investment process only and should not be used as the basis for making any decision about purchasing, holding or selling any securities. Nothing herein should be interpreted or used in any manner as investment advice. The information provided about these portfolio investments is intended to be illustrative and it is not intended to be used as an indication of the current or future performance of Modular Capital’s portfolio investments.

AN INVESTMENT IN A FUND ENTAILS A HIGH DEGREE OF RISK, INCLUDING THE RIKS OF LOSS. There is no assurance that a Fund’s investment objective will be achieved or that investors will receive a return on their capital. Investors must read and understand all the risks described in a Fund’s final confidential private placement memorandum and/or the related subscription posts before making a commitment. The recipient also must consult its own legal, accounting and tax advisors as to the legal, business, tax and related matters concerning the information contained in this post to make an independent determination and consequences of a potential investment in a Fund, including US federal, state, local and non-US tax consequences.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS OR A GUARANTEE OF FUTURE RETURNS. The performance of any portfolio investments discussed in this post is not necessarily indicative of future performance, and you should not assume that investments in the future will be profitable or will equal the performance of past portfolio investments. Investors should consider the content of this post in conjunction with investment fund quarterly reports, financial statements and other disclosures regarding the valuations and performance of the specific investments discussed herein. Unless otherwise noted, performance is unaudited.

DO NOT RELY ON ANY OPINIONS, PREDICTIONS, PROJECTIONS OR FORWARD-LOOKING STATEMENTS CONTAINED HEREIN. Certain information contained in this post constitutes “forward-looking statements” that are inherently unreliable and actual events or results may differ materially from those reflected or contemplated herein. Modular Capital does not make any assurance as to the accuracy of those predictions or forward-looking statements. Modular Capital expressly disclaims any obligation or undertaking to update or revise any such forward-looking statements. The views and opinions expressed herein are those of Modular Capital as of the date hereof and are subject to change based on prevailing market and economic conditions and will not be updated or supplemented. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

EXTERNAL SOURCES. Certain information contained herein has been obtained from third-party sources. Although Modular Capital believes the information from such sources to be reliable, Modular Capital makes no representation as to its accuracy or completeness. This post may contain links to third-party websites (“External Sites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites. These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Sites.